When is the best time to claim Social Security?

Most of us have a vague idea of how Social Security works, or at least we’ve seen that money comes out of our paychecks for it. The basic idea is that when you retire, Social Security provides you with some income for the rest of your life in the form of monthly check. The value of your Social Security checks depends primarily on your lifetime earnings and when you choose to start claiming them.

The decision on when to claim social security can make a big difference; the longer you wait to start taking Social Security, the larger the payments will be.

This is slightly oversimplified, but if you choose to claim your benefits as soon as you’re eligible, at age 62, your payments will only be for 70% of your total benefit. If you wait until you’re 67 you’ll get 100% of your benefit and it’s a sliding scale between those ages. You can actually delay even further until age 70 and get more than 100% of your “full” benefit.

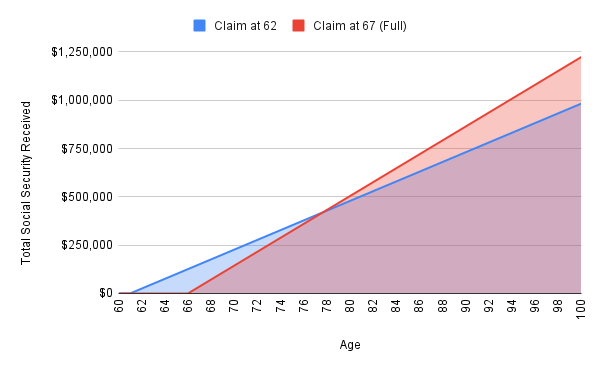

Here’s a quick example. Jenny is approaching retirement and isn’t sure when to claim social security. She uses the Social Security Administration tool to estimate her full retirement benefit at $3,000/month if she retires at her full retirement age of 67. The chart below compares her total payments from Social Security if she starts as early as she can (age 62, in blue) with the total payments if she waits until until her full retirement age (67, in red). You can see that blue payments start sooner and it isn’t until about age 77 that the total of the payments in red overtake them.

This is another key factor in the equation: life expectancy. It’s not exactly a fun topic to think about, but the strategy of delaying taking Social Security benefits works best for those with a longer life expectancy. You should take into account family history, history of illness, and other factors that affect life expectancy.

The bottom line is the longer you wait to claim, the bigger your monthly check will be for the rest of your life.

You get one chance at this, you can’t undo it. So if you don’t need the income at age 62 you should probably wait. This is a complicated topic and we can’t cover all of the details around safe withdrawal rates, spousal benefits, required minimum distributions, and more in a single article, but the principle is sound. Waiting to claim social security, if you can, means a bigger check every month. If you want help with your particular situation, book a chat session with a BrightDime financial coach, they’re here to help!

This article was written in 2023 and makes several simplifying assumptions. For more information on planning for your own retirement you can go to https://www.ssa.gov/prepare/plan-retirement