BrightDime Basics: Balance Sheet

So far in BrightDime Basics we’ve explored assets (things we own), liabilities (debts we owe) and net worth (all assets minus all liabilities). This week, we’re covering the balance sheet. Your balance sheet is the financial statement that summarizes all of the prior concepts. It’s basically a map of your net worth.

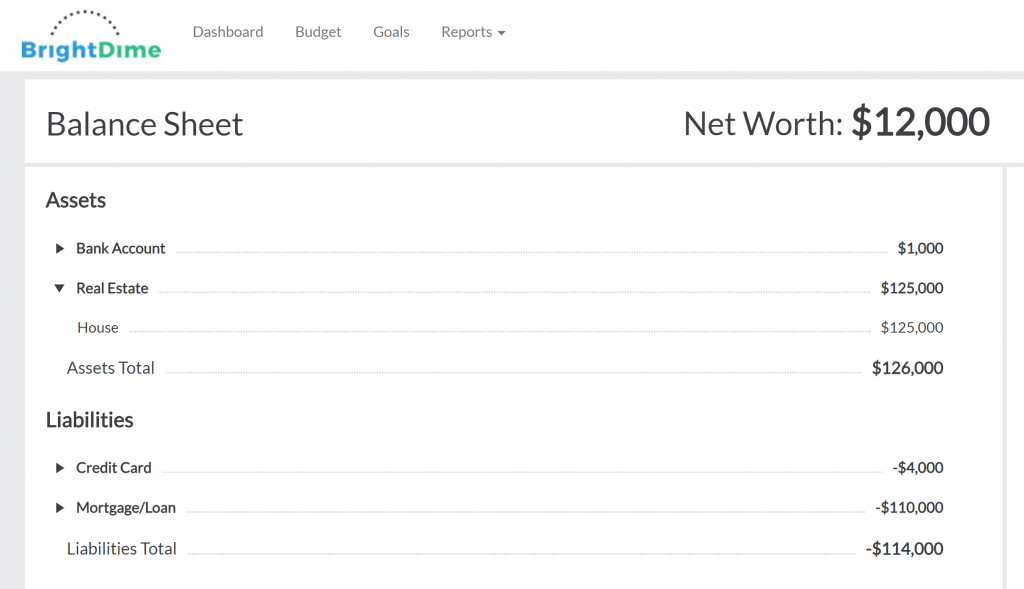

A balance sheet is a snapshot (at a single point in time) of your financial situation. It lists the current values of all of your assets (cash, car, home, investments, etc.) and all of your liabilities (credit cards, loans, mortgage, etc.). These numbers change every day as you buy things, pay down debt, invest, etc. The items on the balance sheet combine to equal your net worth and might look something like this:

All companies have balance sheets (it’s one of the basic financial statements along with cash flow and income statement), but most people don’t have an easy way to see their own. BrightDime keeps an up-to-date personal balance sheet at your fingertips (see yours here). You can download a PDF version whenever you need one: annually for personal record keeping, when you’re applying for a mortgage, or as the starting point when setting up a will. Your personal balance sheet is the simple answer to “what do I own and what do I owe?”

Need help understanding your balance sheet? BrightDime coaches are ready to chat. Just login and get started.