Reviewing your employer’s benefits be confusing, and probably isn’t at the top of anyone’s list of things they want to do. But if you’re not careful you could be making…

Tag: healthcare

Insurance is essentially a tool to manage risks. It’s a balance to determine which kinds of insurance you need and which you don’t need. You need to think about how…

A durable health care power of attorney (HCPOA) (sometimes referred to as health care proxy, advanced medical directive or medical power of attorney) is a legal document that you sign…

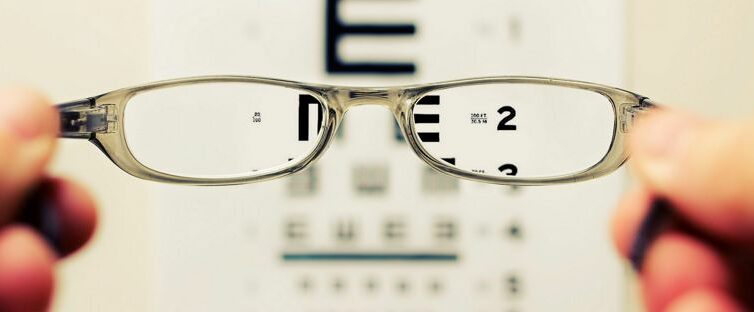

When it comes to your health, take nothing for granted, not even your insurance plan or how it works. With so many types of health plans out there, it’s easy…

If we told you that you could save up to 30% on medical expenses, would you be interested? The cost of healthcare can be overwhelming and even with insurance people…

An HSA is similar to a Health Care Flexible Spending Account (HCFSA); you can pay for health care expenses from this account before taxes, but the HSA has several notable…

A co-payment (copay) is a fixed amount you pay for receiving certain health care services. The remaining balance of the bill is covered by insurance. It’s usually a small dollar…

Coinsurance is the percentage of your medical bill you pay after you’ve met your deductible. You may pay 0%, 10%, 20% or more depending on your plan and whether you…

A deductible is the amount you must pay towards medical expenses during a given time period, usually a year, before your health insurance benefits begin to cover the costs. At…

A premium is the amount of money charged by your employer or insurance company for the health insurance plan you select. It’s usually paid monthly, or each pay period if…