Have You Updated Your W-4 Tax Withholding Lately?

You kinda know how it works. You work all week, get your paycheck and part of it is missing. The culprit? Taxes!

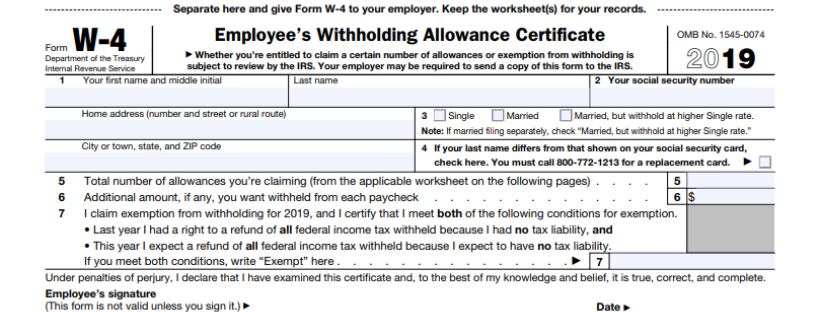

Taxes are withheld based on the IRS Form W-4 (Employee Withholding Allowance Certificate) that you complete for your employer (assuming you are an employee who receives a W-2 at the end of the year)

Don’t remember completing it or how you filled it out? You may have done it years ago when you were hired. And if you haven’t reviewed it lately, now is certainly a good time.

The W-4 form includes information about your marital status, income from any additional jobs, the number of dependents you are claiming, and any additional amount you want withheld from each paycheck. You can change the information on your W-4 forms as often as you need.

As you work throughout the year, your employer keeps a portion of your pay based on IRS withholding tables and the information on your W-4 . Your employer takes the money withheld and makes estimated payments called “withholdings” directly to the IRS on your behalf.

The less your withholdings, the less money (taxes) is withheld from your paycheck so your paycheck is larger now. The more taxes are withheld, the smaller your paycheck will be throughout the year.

Then at tax time the next spring, when you complete your tax return and calculate how much you owe in taxes, that amount is compared to what has already been withheld throughout the year. If you withheld more than you owe, you’ve essentially overpaid and that’s when you get a tax refund. If you owe more than was withheld, you have to make a tax payment for the difference.

It’s important to note that you pay the same amount in taxes whether you get a refund or owe the IRS. So your withholdings don’t change the amount of taxes you pay, just when it is paid.

The IRS recommends that you check your W-4 every year, or at least when your personal or financial situation changes. They offer a withholding calculator on their site to help you determine the best way to fill out your form. You will need your prior year return and a current paycheck to complete it. Here is the link.

If you end up of owing taxes this year or getting a big refund, do a “paycheck checkup” by reviewing your withholdings as soon as possible for the remainder of the year.

**This article was written in March of 2019 and updated in 2024. Make sure you’re considering the most recent tax code before making any changes to your withholdings or tax returns.**