No More Excuses: Start Investing in Your Future

If you’ve ever found yourself thinking “I’ll start investing when I’m older, I have plenty of time” or “I’ll start investing when I have more money, there’s no point in starting now” then you’ve fallen prey to the myth that investing is for older, wealthier people. The truth is exactly the opposite: the best time to start investing for your future is as early as possible. Whatever reasons you have for delaying are just holding you back.

When we say “investing for the future” we’re generally referring to tax-advantaged retirement accounts: a 401(k) offered by your employer, a personal IRA, or one of the other less common types of retirement accounts.

These accounts offer significant tax advantages over investing in a straightforward brokerage account and are the best place to start investing for almost everyone. The good news is that there are no minimum contribution requirements for 401(k) plans. That means you can get started with as much or as little as you like. IRA accounts are offered by the private sector and can have account minimums, but there are options out there with no required minimum.

The bottom line is that you can start investing in these tax advantaged retirement accounts with very little money, so “I don’t make enough to invest” isn’t an excuse. “I’ll invest when I’m older” is an even more damaging version of this myth.

That’s because time is one of the most important factors in determining how successful your investment strategy is.

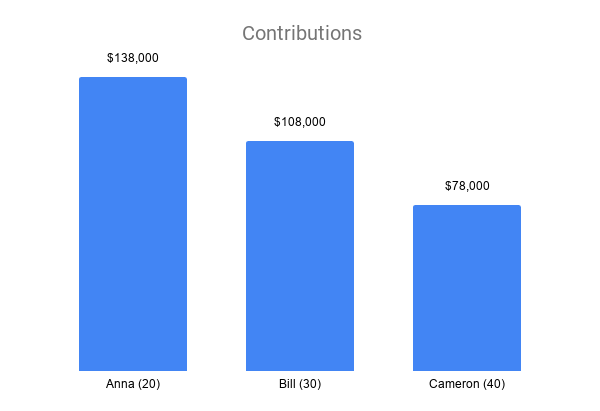

A quick example is the best way to show this. Let’s look at 3 people: Anna, Bill, and Cameron.

Anna starts contributing to her 401(k) as soon as she starts her first job, at 20. She contributes $3,000 that year, and every year afterwards, until she retires at 65.

Bill gets started with investing a little later, at age 30. He also contributes $3,000 a year every year until he retires at 65.

Cameron gets started even later, at age 40. Contributions are the same $3,000 every year until 65.

Anna, Bill, and Cameron all invest in the same thing, so their investment returns are identical (here we’re assuming 6% a year to simplify things). You may be thinking “of course Anna will have more than Bill or Cameron, she contributed $3,000 a year for 10 more years than Bill and 20 more years than Cameron.” And you’re right. Contributions alone (what they saved from their paycheck and put into their retirement accounts) do favor starting early. Ignoring investment returns Anna saves $138,000, Bill saves $108,000, and Cameron saves only $78,000. Here’s how that looks in comparison.

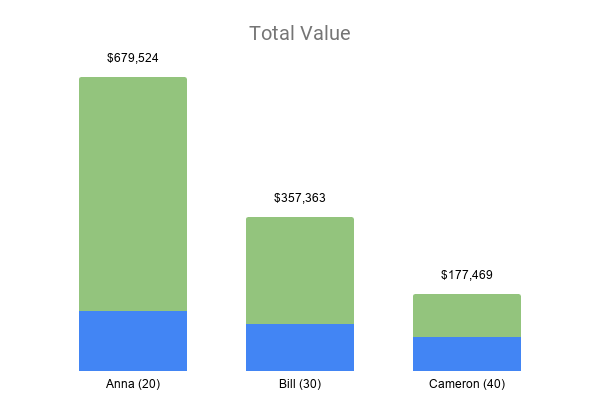

But that’s not the most important part of starting early. Remember that all 3 in our example get the exact same returns every year and retire at the same age.

By starting 10 years earlier, Anna’s 401(k) is worth almost $680,000 when she retires, Bill’s is worth about $357,000, and Cameron’s is only $177,000.

This is the magic of compound interest plus time. Looking at this you can clearly see the value in starting early – remember the green portion is ONLY because of starting early.

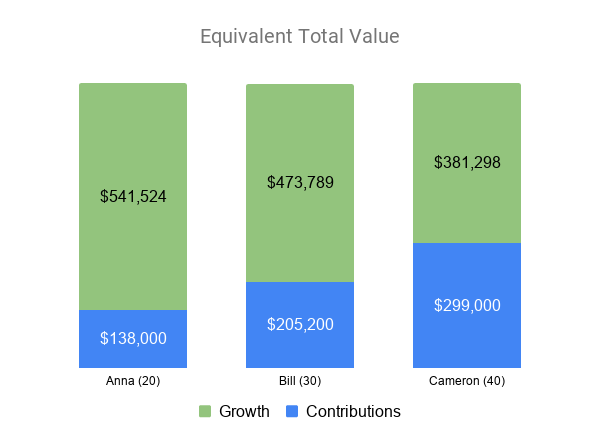

Another way of looking at this would be to consider how much Bill and Cameron would each have to contribute every year to end up with the same amount as Anna at age 65. Check it out below. Bill has to contribute $5,700 per year ($67,000 more in total than Anna) and Cameron $11,500 per year ($161,000 more than Anna) to catch up and end up with approximately the same amount at retirement.

Bottom line: starting early is hugely important when thinking about investing and you can start with pretty much any amount you want.

We didn’t even include any additional growth from available company match you may qualify for. No more excuses, no more procrastinating.