What Exactly Is a Marginal Tax Rate?

The United States has what is known as a “progressive” tax system, meaning individuals with lower income are taxed at a lower rate than people with a higher income.

Your income determines what tax bracket you fall into, and therefore what marginal tax rate you will pay.

This simplified description, where higher income equals higher marginal tax rate can cause confusion. It’s the source of one of the most persistent financial myths we see. You’ve probably heard it too. To make it as clear as possible:

It is a myth that getting a raise that pushes you into the next tax bracket will mean you actually make less money since your tax rate increases.

Here’s a simplified quick example of how the myth would work (if it was true) (which it isn’t).

Alice makes $37,000 a year which puts her in the 12% tax bracket (using 2019 figures.) In our simplified example 12% of $37,000 is $4,440. Paying $4,400 in taxes leaves her with after-tax income of $32,560.

When Alice is given a raise of $3,000 it raises her salary to $40,000! But that means she’s now in the next tax bracket up (it starts at $39,476), at a 22% tax rate. If we re-run that tax calculation in her new tax bracket she now owes 22% of $40,000 or $8,800. That leaves her with after-tax income of $31,200 after the raise. She got a raise but is left with $1,360 less after taxes. She should turn down that raise right?

Wrong. The key word here is marginal.

Your marginal tax rate is the tax rate applied to the next additional dollar of income you earn, and doesn’t apply to every dollar you earn in a year.

So in our example, Alice wouldn’t be paying 22% on all of her income after the raise. And in fact, she wouldn’t be paying 12% on all of her income even before the raise. The first $9,700 she earns would be taxed at 10%, income between $9,701 and $39,475 is taxed at 12%, and income over $39,476 is taxed at 22%. This works basically the same no matter how much income someone has.

Only additional income over a tax bracket’s upper limit is taxed at the higher rate, not all of the income.

Here’s how it actually breaks down for Alice before and after the raise.

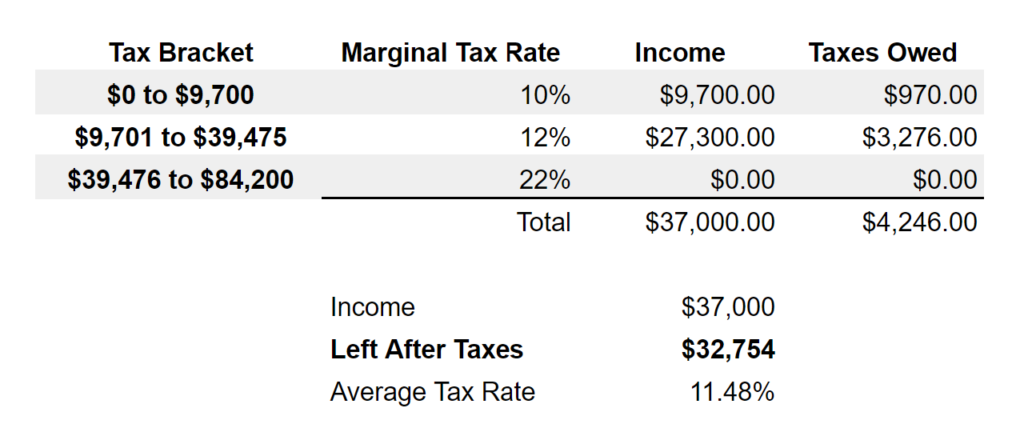

Before The Raise ($37,000 income)

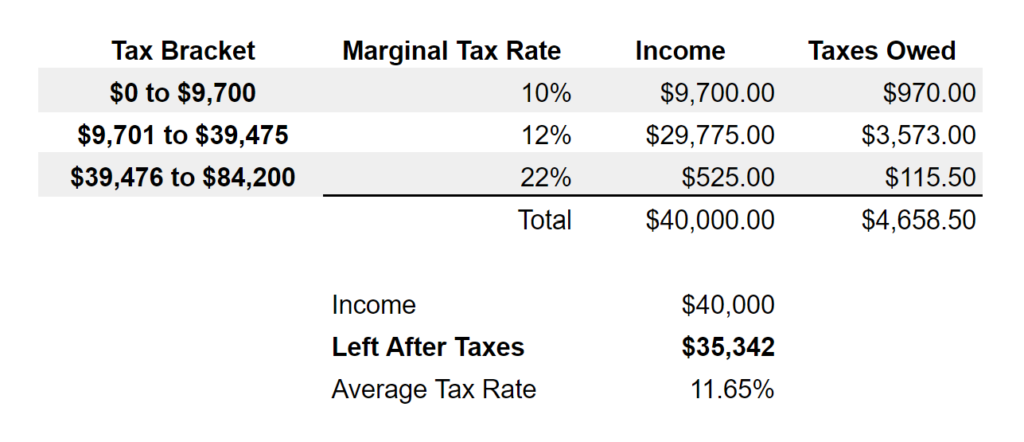

After the Raise ($40,000 income)

As you can see she’s bringing home $35,342 after the raise, $2,588 more than she was before the raise. She should take the raise.

This myth is persistent for a reason: taxes are complicated. We’ve oversimplified here to make the examples easier to follow but the principle stands. Your tax bracket’s marginal tax rate is not YOUR overall tax rate. Everyone’s income is taxed the same by these brackets, your first $9,700 is taxed at the same rate as someone who makes twice as much as you, as is the next approximately $30,000, and so on. The additional income over a tax bracket’s upper limit is what is taxed at a higher rate.

It’s worth mentioning that the examples we’ve given here ignore tax credits, deductions, etc and don’t represent what someone making this amount would actually pay in taxes. The basic idea and conclusions don’t change when you include that information, it just gets more complicated to arrive at a final number.