Am I doing okay with money?

One of the most common questions our financial coaches get is simply, “Am I doing okay?” It sounds like an easy yes or no question, but as we teach at BrightDime, personal finance is not a one size fits all solution. The answer to that question is subjective, but one way you can objectively start to answer this is knowing your net worth.

What is net worth?

Net worth is a simple and objective way to measure your financial stability. Assets are the things you own like the cash in your wallet, savings, your car and your home. Liabilities are what you owe, otherwise known as debt such as what you owe on your credit card, student loans and mortgages.

Here is net worth in a simple equation:

NET WORTH = Assets – Liabilities or

NET WORTH = What you own – what you owe

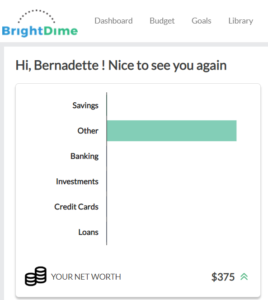

Your net worth is the difference between the total values of your assets and liabilities. Use our helpful net worth tool to figure this out and securely track all your financial information in one place.

What does my net worth tell me about my finances?

If after you use the net worth equation and you find your net worth number is positive, that’s great news! It means you own more than you owe. However, if you find that your net worth is negative, that’s okay, don’t worry. It just means we have some more work to do towards becoming more financially stable.

It’s important to remember that your net worth isn’t the same as YOUR worth. While it is a simple way to gauge your finances at a point in time, it does not define you! However, keeping it trending positively and paying attention to what affects it, can definitely reduce your money stress.

How can BrightDime help me with my net worth?

Our financial coaches work through questions like this every day with BrightDime users like you. It’s a bright idea to view your net worth on BrightDime weekly to remind you where you are currently and to help you make important decisions. When considering a financial decision, we encourage you to ask yourself:

Will this decision increase or decrease my net worth over time?

Let’s walk through a simple example together.

Let’s say you have $1000 in a savings account and a credit card balance of $400. If this was all you had for assets and liabilities, your net worth would be $600 since $1000 (asset) – $400 (liability) = $600 (net worth).

Paying off the credit card may seem like it doesn’t affect your net worth, but in the long run it can. You transfer money from your savings account (decreasing the value of that asset to $600) to your credit card balance (reducing the liability to $0).

Your net worth today won’t change because it’s still $600. But in the future, you can increase your net worth if you keep your debt at $0 and you’ll spend less money on credit card fees and interest that you can instead use to build wealth. Let’s keep moving in the positive direction today!

Head to the dashboard and start a chat with us now.