How can I overcome my money troubles right now?

If you’re feeling panicked about your money right now, breathe and start reviewing your current situation with these six steps.

#1. Let’s start with looking at your monthly income and expenses.

Sort between your necessities (rent, mortgage, car payment, insurance, loans, etc) and other nice to have expenses (cable, shopping, eating out, gym, subscriptions).

#2. Next, ask yourself these questions:

- Anything from the second group you can pause or stop for a while?

- Can I pick up extra income through unemployment benefits, part-time work or other sources?

- Do I have anything I can sell to get through this tough time?

Every little bit counts. Don’t gloss over small amounts because they can add up to a lot over time.

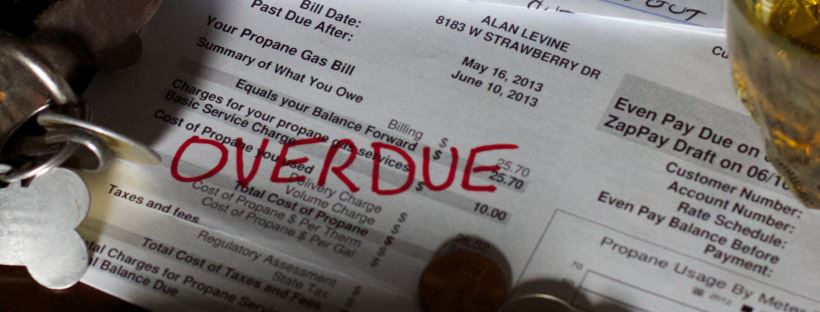

#3. Proactively reach out to your lenders and ask for help.

If you’re in danger of missing rent, mortgage, credit card or other loan payments, it’s best to be proactive and contact your lenders in advance and let them know. They may have programs to help you get through tough times. You must call and ask though because they don’t publicize these programs.

Credit card issuers may offer relief by temporarily lowering your interest rate, waiving fees and/or offering alternative payment plans.

Mortgage companies may offer a loan modification to extend the length of your term, lower your interest rate, or change from a variable interest rate to a fixed-rate loan to prevent you from going into foreclosure.

For medical debt, try calling your hospital or doctors office to see if they offer any assistance, like an interest-free repayment plan. Unlike other creditors, hospitals may offer financial assistance or be willing to negotiate the amount you owe.

#4. Understand your insurance coverage.

You should also consider different types of insurance as a financial safety net (renters, homeowners, medical, auto, life, etc) to cover bigger events. Check with your insurance agent to understand what you have covered now and about adding coverage to your policy for specific emergencies you’ve experienced in the past.

#5. Consider debt as a last resort.

It’s never good to take on additional debt when you’re already in a financial hardship, but sometimes it’s your only option. Borrowing from family, friends, utilizing employer programs, personal loans, 401K loans or hardship withdrawals, are options you can consider. Research these before increasing your balance on a high interest rate credit card.

Once you take on additional debt, make sure you have a solid plan, so the payments and interest don’t get away from you. It can be hard to face, but ignoring will only make it worse.

#6. Don’t feel like you have to manage this alone.

Don’t feel ashamed. Financial hardships can hit anyone, at any time. It can be with a natural disaster, medical bills from an illness or accident, loss of income, or even just a slow build up of expenses over time. You are not alone, but it can often feel that way when you are experiencing a particularly challenging time in your life and money.

Luckily, that’s what your BrightDime coaches are here to do — help you get through times like this. Head to the dashboard and start a chat now.