Where do I start when organizing my finances?

Managing your money can be overwhelming.

If you’re not sure where to start, don’t worry, you are not alone, and you’re not doing anything wrong. Learning how to manage money is a skill that takes practice over time.

Just with learning any other new skill, you can begin with just assessing where you are today. That’s where BrightDime can help you feel less overwhelmed, and get more organized through your personal balance sheet.

A personal balance sheet provides an overall snapshot of your financial situation at a specific period in time.

It is a summary of your assets (what you own), your liabilities (what you owe), and your net worth (assets minus liabilities).

Assets include things you own like cash, your home, your car and investments.

Liabilities are your debts like credit card balances, car notes, mortgages and student loans.

How can a personal balance sheet help you get started?

Companies use balance sheets to assess how they are doing financially at any point in time. In the same way, you can use a balance sheet to do a pulse check on your finances and figure out where you can focus your time and energy on improving your money habits.

Simply put, the more you own and the less you owe, the higher your net worth is, and generally the healthier your finances are.

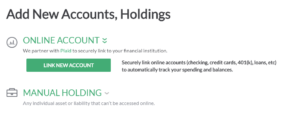

You can create your own balance sheet by adding each of your asset accounts and your debt accounts into your BrightDime dashboard. You have the option to add your online accounts through our secure connection, or you can type in assets and liabilities through the manual holdings option.

Once you add all your accounts, BrightDime can help you keep an up-to-date personal balance sheet at your fingertips.

You can download a PDF version for times you need your financial snapshot to make important decisions like:

- annual record keeping

- applying for a mortgage

- starting point when setting up a will

But for today, you can use your balance sheet to put together a plan with your BrightDime coach on whatever you want to improve in your money situation. Having this data makes planning more individualized and specific to you, versus getting generic financial advice.

Ready to start? Head to your BrightDime dashboard to add in your accounts and meet with your BrightDime coach today!