Modified adjusted gross income (MAGI) begins with AGI (adjusted gross income) and adds back any deductions taken for foreign income and housing, student loans, self employment taxes, Individual Retirement Account…

Author: BrightDime

Adjusted gross income (AGI) is a measure of income used to calculate how much of your income is taxable. It starts with things like wages, dividends, capital gains, interest, rental…

Tax time can feel like it’s all bad news but there are two bright spots. Tax credits and tax deductions are types of tax breaks that (generally) apply to those…

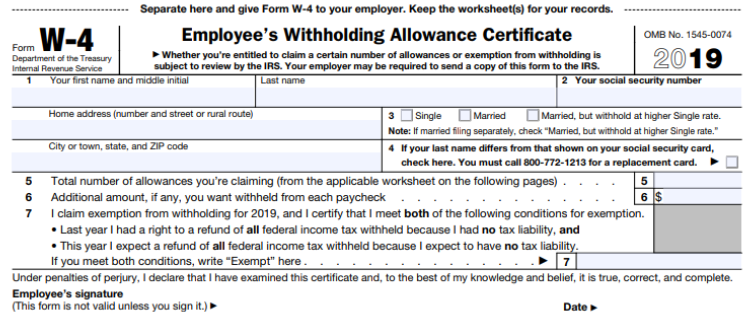

You kinda know how it works. You work all week, get your paycheck and part of it is missing. The culprit? Taxes! Taxes are withheld based on the IRS Form…

A tax credit is an amount that eligible taxpayers can subtract from their taxes owed based on certain criteria determined by the IRS. It is a dollar for dollar reduction…

Your taxes are estimated and withheld periodically from your pay as you earn money throughout the year. At tax time (usually April 15th) you “true up” with the IRS when…

Your taxes are estimated and withheld periodically from your pay as you earn money throughout the year. At tax time (usually April 15th) you “true up” with the IRS when…

Tax withholding is the amount of federal income tax withheld from your paycheck before you receive it. The amount of tax your employer withholds from your pay depends on a…

A debt snowball is a debt repayment strategy that prioritizes paying off your debt with the smallest balance, moving to the next smallest once the first one is paid off, gaining momentum…

A debt avalanche is an accelerated debt repayment plan that prioritizes paying off debt with the highest interest rate, saving you money in total interest paid compared to other methods. You…