You kinda know how it works. You work all week, get your paycheck and part of it is missing. The culprit? Taxes! Taxes are withheld based on the IRS Form…

Tag: taxes

A tax credit is an amount that eligible taxpayers can subtract from their taxes owed based on certain criteria determined by the IRS. It is a dollar for dollar reduction…

Your taxes are estimated and withheld periodically from your pay as you earn money throughout the year. At tax time (usually April 15th) you “true up” with the IRS when…

Your taxes are estimated and withheld periodically from your pay as you earn money throughout the year. At tax time (usually April 15th) you “true up” with the IRS when…

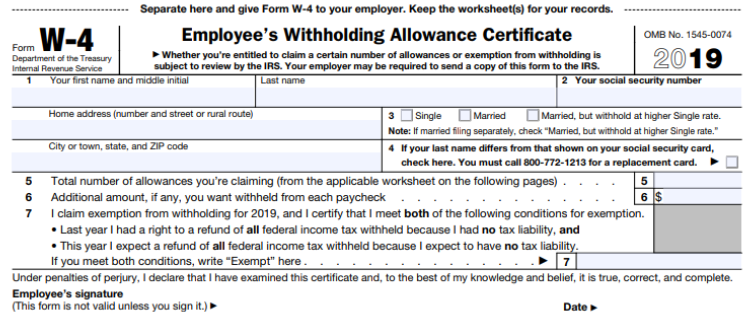

Tax withholding is the amount of federal income tax withheld from your paycheck before you receive it. The amount of tax your employer withholds from your pay depends on a…

Once you have all your current year tax documents ready it’s time to prepare and file your taxes. There are a number of options available to you and they vary…

Protecting your finances can feel like a full time job. Beyond some basic password advice, keeping an eye out for phishing and identity theft attempts, and spotting financial scams early,…

We all have that pile of “important” documents that we’re not sure if we should keep or toss. Or maybe you get most things electronically now and have been saving…

You pick up the phone and hear, “This is the IRS calling about an overdue tax payment.” If you’re like most people, that’s enough to make you a little nervous.…

It’s almost time to start preparing for filing your taxes. Whether you’re filing on your own, using a software provider like TurboTax or TaxAct, or working with a qualified tax…