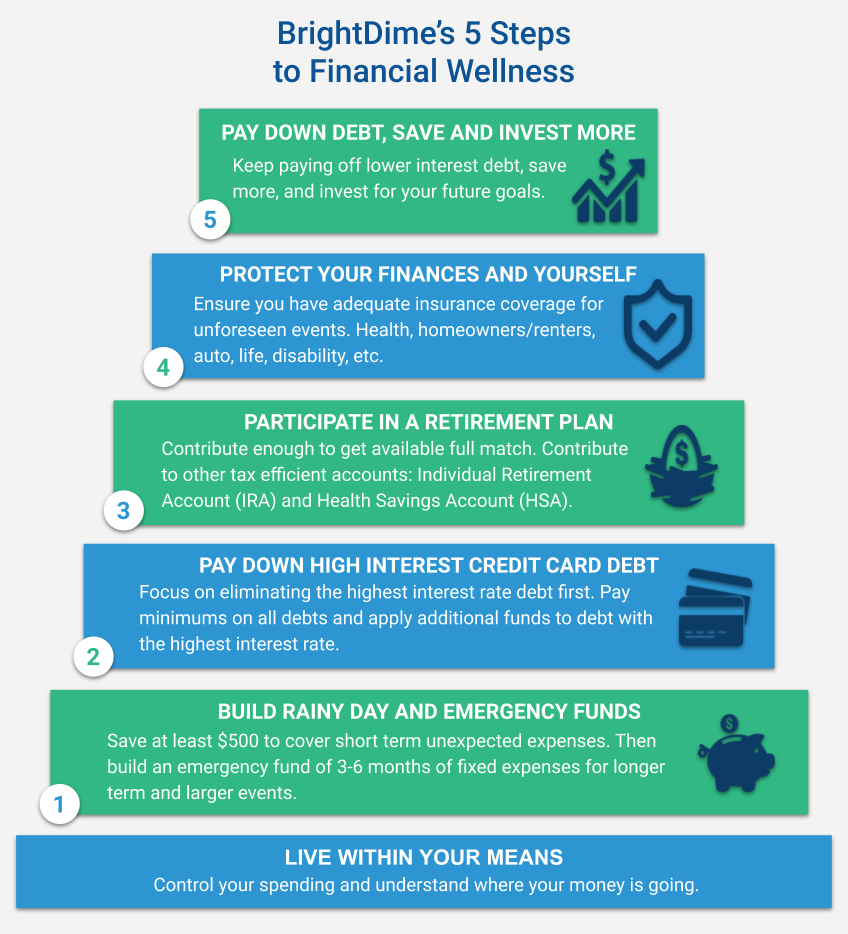

BrightDime’s Steps to Financial Wellness

Financial wellness is building a lifetime of good financial habits. It doesn’t happen overnight, or even in a few months. It takes time and effort but the reward of worrying less about money and feeling more confident in your future is worth it. You may already be well on your way to financial wellness, or your journey may be just beginning. No matter where you are, these steps will help you progress.

It all starts with living within your means – spending less than you bring in every month. Without mastering that step first, and doing it consistently month after month, it’s very difficult to move ahead with anything else. Technology makes it easy for us to buy things (swipe, tap, etc), but if we aren’t careful, we can quickly spend more than we make in a month. The key to staying vigilant is to track your money coming in (income) and money going out (spending). You can do this by creating a budget. There are many kinds to choose from. The simplest start with broad guidelines while others track and plan for every cent. One size does not fit all so use whichever works for you.

Saving up some cash for short term and medium term unexpected expenses comes next. This is what we refer to as your rainy day fund. This is important because having cash saved to deal with these little emergencies lets you handle the expense without going into debt. Whether it’s using a credit card or other short term loan more debt takes a while to pay off, costing you even more in interest. This money is best kept in a savings or checking account for quick access when your unexpected event happens. Find the best interest rate you can but return on your money isn’t the primary concern here.

Next we recommend paying off high interest debt (usually that means anything 10% or higher) as aggressively as possible. Why? Compound interest. It increases the amount you owe every day you still have the debt. Borrowing money is not free, and with interest over 10% it gets expensive, fast. Start by selecting a debt repayment strategy that works for you and put all your extra funds (side gig, selling items, bonus, tax refunds, etc) towards paying it off. If you’re having trouble finding extra money, revisit your budget and see if you can adjust anything. Every dollar you pay off is a dollar that isn’t being charged interest in the future.

Once that’s taken care of make sure you’re investing for the future in a tax-advantaged retirement plan; at work in a 401(k) and/or HSA or independently in an IRA. The best time to start investing for your future is as early as possible. If your employer provides a company match, always contribute up to the match, more if possible! And in most cases you’re reducing your current taxes while you invest in your future – a win/win.From there you want to make sure you have different types of insurance (health, life, home, car, etc) that are appropriate for you and your family. These protections are considered a financial safety net and important to manage different risks you may encounter throughout your life that could be catastrophic to your finances if uninsured.

After that it’s really about optimizing – how can your money best help you achieve your specific goals? It may be putting more towards lower interest rate debt (paying more toward student loans, mortgage, car loan, etc – whichever rate is higher) or putting more in savings and investing. The best place is where you’ll get the most return on your money, both financially and mentally. If having any debt is a constant source of stress, focus on that. If you want a bigger safety net you should prioritize growing your emergency fund.

You don’t have to only work on one step at a time and you don’t have to figure it out on your own. BrightDime’s coaches are here to help you figure out how to best tackle your best next step.