How do you protect the things you value most in your life (family, health, home, car, etc) in case something unexpected happens? How would an accident, illness, or injury impact…

Category: Uncategorized

When you’re ready to invest for your long term goals you’ll need to choose where to do that. We don’t mean what to invest in , that’s a different step.…

April is Financial Literacy Month and we asked executives at several of our clients to share things they’ve learned in their financial life that they wish they had known sooner.…

What’s the difference between saving and investing? The terms get used interchangeably sometimes but they’re not the same and knowing the difference between the two will help you plan for…

Tax loss harvesting sounds like something you might do in the garden during the fall. But it’s actually an advanced tax strategy that uses investment losses to reduce your taxes…

Nobody wants to pay more taxes than they have to. The two most common ways to reduce what you owe are tax deductions and tax credits. Tax credits reduce your…

National Credit Card Reduction Day is March 21st, a “holiday” you probably won’t see any cards for at Hallmark. Nonetheless, we think the goal of urging people to pay down…

Tax time can feel like it’s all bad news but there are two bright spots. Tax credits and tax deductions are types of tax breaks that (generally) apply to those…

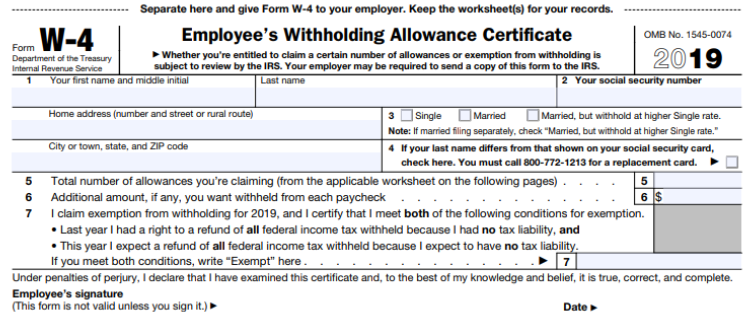

You kinda know how it works. You work all week, get your paycheck and part of it is missing. The culprit? Taxes! Taxes are withheld based on the IRS Form…

Once you have all your current year tax documents ready it’s time to prepare and file your taxes. There are a number of options available to you and they vary…