BrightDime’s financial coaches have expertise in a wide range of topics: budgeting, debt reduction strategies, insurance, workplace benefits, investment products, and on and on. So what is that they can…

Tag: Financial Checkup

Managing your money can be overwhelming. If you’re not sure where to start, don’t worry, you are not alone, and you’re not doing anything wrong. Learning how to manage money…

An HSA (or Health Savings Account) has three separate tax advantages that make it an important saving (and even investing) option for employees who have access to them. HSA contributions…

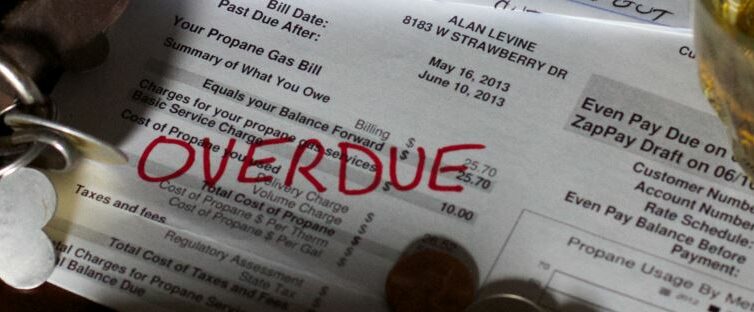

If you’re feeling panicked about your money right now, breathe and start reviewing your current situation with these six steps. #1. Let’s start with looking at your monthly income and…

If you search “how big should my emergency fund be?” you’ll find a lot of different answers. Everything from “you don’t need one” to “a full year’s worth of expenses.”…

If you own your home and have been making your regular mortgage payments, you may have some equity. Equity is the value of what you own in your home: the…

Do you use a credit card for emergencies? You are not alone, as many of us were taught to keep a credit card, “just in case.” More than 189 million…

If you want to buy a home, a car, or rent an apartment your credit score can mean the difference between a “yes” and a “no”. And if you do…

Goals keep you motivated and help give purpose to otherwise mundane tasks like saving, budgeting, and investing. But what’s better than a goal? A SMART financial goal because it is:…

Staying organized can be a challenging task. It seems like everything works against us to make things more complicated and harder to keep up with. But it’s worth it, just…